Omdia is part of the Business Intelligence Division of Informa PLC

This is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC's registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Informa

Articles & Insights

How to navigate sustainability in economic uncertainty

Jackie Park, Editor

In times of economic change and uncertainty, sustainability initiatives end up on the chopping block first. Presidential elections, wars and other forces beyond our control can cause changes to a company’s balance sheet. Besides, the economy is volatile. How can you prepare for the unknown? Read on to learn how your company can get ahead of economic uncertainty and stay on track for its sustainability initiatives.

Keeping your team on board

Maybe you have a team dedicated to your sustainability strategy and other related initiatives. Maybe you’re carrying the torch on your own. No matter the case, securing buy-in from your teammates and higher ups is important. Be ready to quantify and vouch for your strategy should anyone bring up concerns.

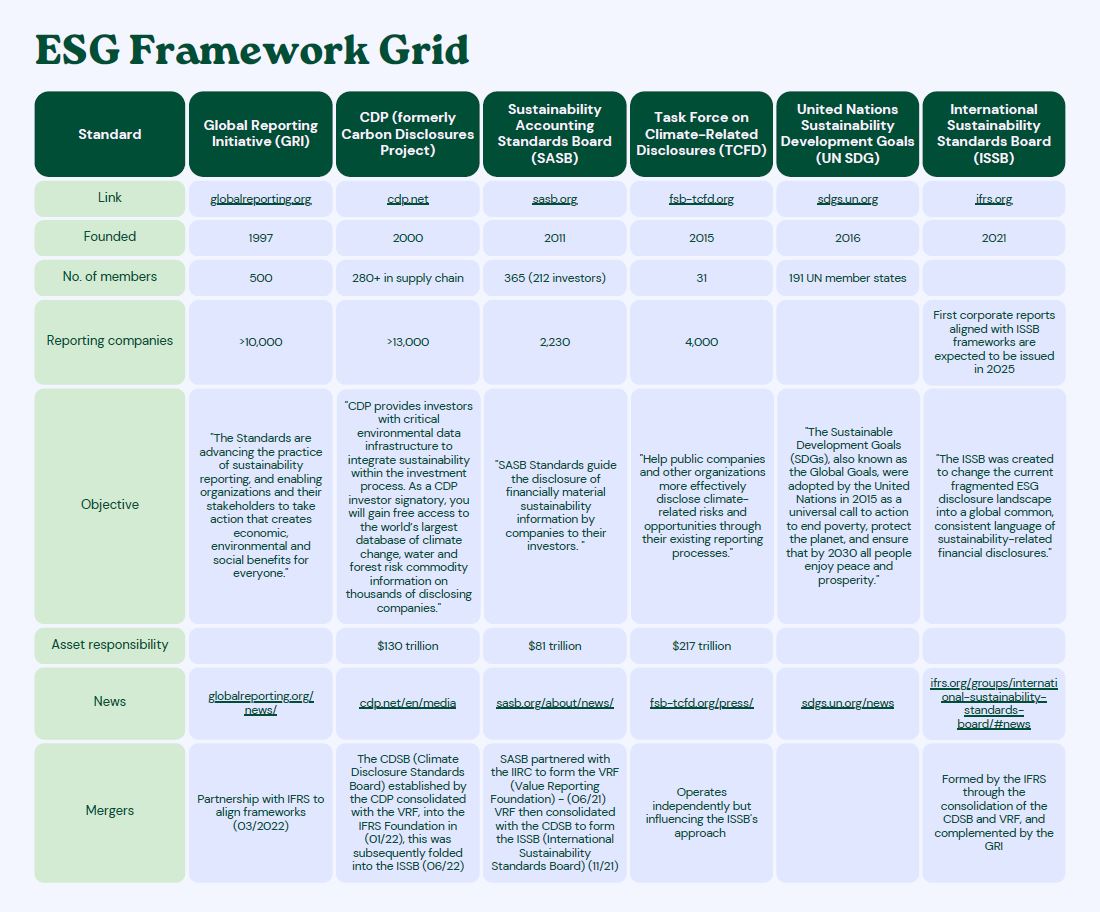

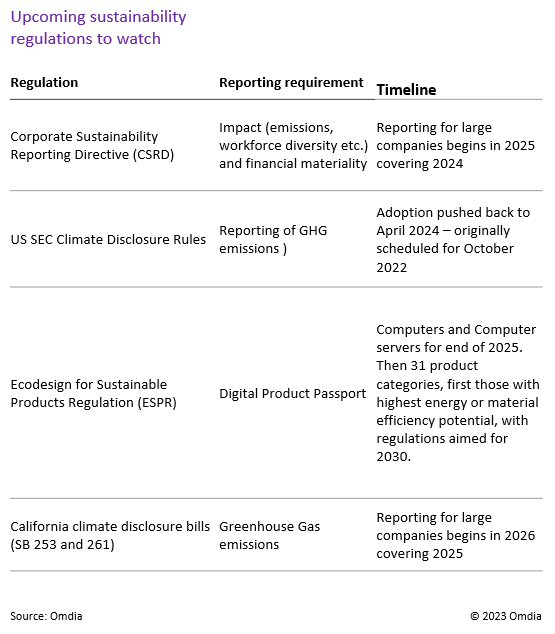

First, recall that in many instances, reporting and other regulatory measures don’t just disappear because the stock market is in a state of transition. Dedicating resources to these measures isn’t just a “nice to have,” it’s essential. Without someone to track emissions and comply with standards, your company could be facing fines and other retaliatory measures.

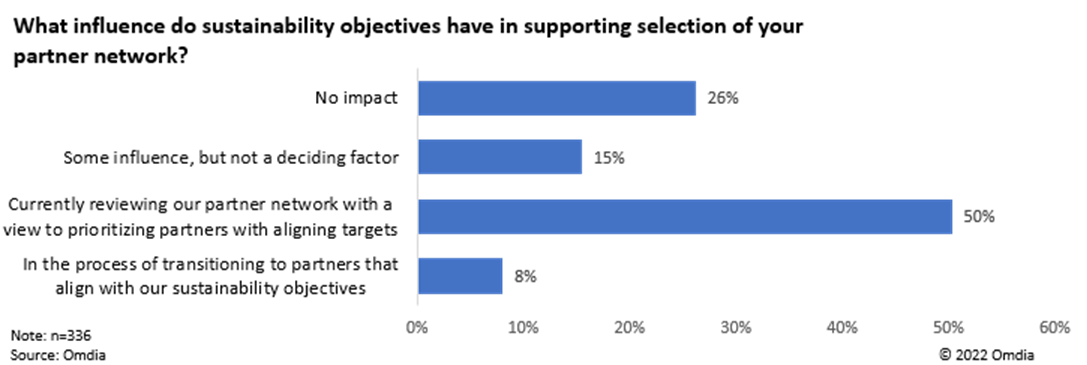

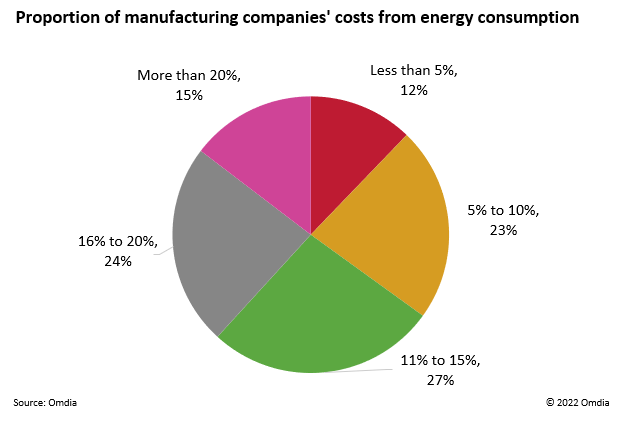

ESG strategy can be a selling point to boards and other executive-level teammates in many ways. Namely, cost savings. According to the Vanderbilt School of Management, sustainability practices can result in significant cost savings as fewer resources are used and less energy is consumed. Plus, the “power of procurement” can lead to a smaller footprint through supplier sustainability agreements and make better use of scarce resources.

Research has also shown that companies with robust sustainability strategies are far less likely to be impacted by a recession and come out of uncertain economic situations with resilience. Companies who are just in it for the money don’t tend to fare as well as those who are in it for the mission.

What to focus on with a limited budget

From regulations to mitigation strategies to everything in between, there are a lot of options when it comes to deciding where to use your resources. Particularly if your budget has been trimmed, where do you start with your priorities?

The best place to start is assessing your needs. Depending on your location and industry, you may have certain legal obligations – those things should probably sit pretty high on your list of needs.

In addition, before making any changes, it’s best to understand your company’s specific impact and opportunities for improvement. If you work in a high polluting industry or a smaller company, you might have more low-hanging fruit to address. If not, you may want to spend more time in this step to assess where your company sits.

Setting goals is an important next step. Create goals that are “SMART.” Specific, measurable, attainable, relevant, and time bound. This will help your team create goals that help your company achieve real impact. Don’t be afraid to start small. You don’t need to completely redo your company’s approach to new buildings. But maybe there are new technologies to research for carbon capture or some packaging swaps that could reduce emissions. Check out this list for a few other options.

Prepare for change

Whether the economy is the most stable it’s ever been or it’s changing day in and day out, prepare yourself for changes. New regulations are coming in every day. Your budget may change. Your team may shift. Whatever the circumstances, be flexible and ready to adapt. Sustainability is an everchanging industry and what you will be called to do tomorrow may be dramatically different from what you’re attacking next month or next year. Goals aren’t achieved in a day and it’s helpful to remind yourself to be patient and adaptable.

Election Day: What would each candidate’s presidency mean for U.S. manufacturing?

Jackie Park, Editor

In less than one week, Americans will cast the final ballots in the 2024 election, bringing a long election cycle to an end.

Both Vice President Kamala Harris and former President Donald Trump have promised to revitalize the U.S. manufacturing industry and have each approached sustainability on their own terms. But what could a Harris or Trump presidency mean for the manufacturing industry? Let’s explore.

Harris’s plan to renew the industry

Harris’s record on manufacturing points strongly toward legislation passed by the Biden Harris administration. Examples of this include the Inflation Reduction Act Bipartisan Infrastructure Law, the CHIPS and Science Act, and the American Rescue Plan, which supported more than 60,000 infrastructure projects, created more than $900 billion in private sector investments, and doubled investments in construction of new manufacturing facilities, according to her platform. The Inflation Reduction Act is widely considered the largest investment in clean energy and climate action ever.

Harris says her presidency would not be a continuation of Joe Biden’s. Her platform mentions key policies that are relevant to the industry: labor unions, the federal minimum wage, and continued support for semiconductors, automotive, clean energy, artificial intelligence, and other related industries. Her plan to raise the minimum wage and pass legislation like the Protecting the Right to Organize Act and Public Service Freedom to Negotiate Act would benefit workers who choose to organize and bargain. Plus, Harris plans to close corporate tax loopholes and throw support behind critical goods, like the ones mentioned above.

Trump’s take on tariffs

The primary focus of Trump’s platform as it relates to manufacturing is keeping things domestic. He states, “We must unleash American Energy if we want to destroy Inflation and rapidly bring down prices, build the Greatest Economy in History, revive our Defense Industrial Base, fuel Emerging Industries, and establish the United States as the Manufacturing Superpower of the World. We will DRILL, BABY, DRILL and we will become Energy Independent, and even Dominant again.” Trump does not point to specific legislation in his platform, but says his priority is protecting American workers from foreign competition.

Trump plans to set tariffs on a majority of foreign goods entering the United States, a plan that would impact manufacturers as machine parts and other goods needed to create products are shipped to American factories with a higher price tag.

A look at Trump’s presidency points to a drop in the total number of people working in manufacturing in the U.S. by almost 200,000, however it is difficult to decipher what may have been impacted by the pandemic.

Does it really matter?

There’s no denying that the American manufacturing industry has changed in the last decade. More automation. Artificial intelligence. Union relations have changed. Ultimately, manufacturing is unlikely to return to the way it was a decade or two ago with small towns becoming hubs for particular manufacturers. That’s not necessarily a bad thing – investment in electric vehicle production and other clean energy technologies is way up. Manufacturers have the chance to drive artificial intelligence-powered production with people as specialists. There is so much opportunity for growth that doesn’t rely on who sits at the White House.

Growing the manufacturing labor pool

Part three: Retaining talent

Katelyn Galer, Senior Analyst, Omdia

With the landscape of the workforce changing, dedicated effort is needed for manufacturers to compete in growing their labor pool. Part one of the series covered broadening the appeal and tapping new demographics, with methods like community outreach, and student outreach at high school and secondary level. Part two of the Growing the Talent Pool series covered attracting and developing talent through skill-based hiring, and training programs like internships and apprenticeships. Part three of the Growing the Talent Pool series will focus on retaining existing talent.

When new talent has entered the workforce, they need motivation to stay. This is important for the overall number of people in the workforce, but also a convenience and financial motivation for the individual company. Replacing employees is expensive and time consuming.

To retain talent, focus on what motivates employees and what reasons they leave. Pay is an obvious enticement for employees, but Gen Z and Millennials both value advancement and development to keep them happy in their careers. Many people change jobs because changing companies is the quickest way to get a raise or a promotion; having a system and culture that keeps up with competitive wages and advancement can keep employees satisfied and retain company knowledge. This paired with a robust mentorship and training program keeps employees happy, motivated, and growing in their skills and expertise. Internal mentorship programs can help employees learn company norms and provide insight to development in both soft skills and technical skills. Training programs as standalone events or in coordination with colleges and universities can ensure that employees are keeping up with skills and technologies and provide opportunities to advance to higher positions.

With the changes to the world and work environment, flexibility is another area where manufacturing can seem out of touch with other industry norms. Work from home might not be possible for front-line manufacturing workers, but providing shift options like 5-8 (five 8-hour days), 5-4/9 (five and then four 9-hour days), 4-10 (four 10-hour days), or varying start times, along with generous paid time off, can all contribute to a culture of flexibility that appeals to many. With more dual-income families, dependent care becomes a concern for both working adults, flexible start times can ensure employees can meet school, daycare, or in-home care start times.

Different shift schedules work better for different people. The option to work four 10-hour days can help employees cut down on commuting costs and provide time off during normal weekday hours for appointments and errands that might regularly conflict with work schedules. However, the longer days may be a concern for some employees, so the 5-4-9 schedule where people work 5 days one week and 4 the following week for 9 hours most days is another possible option, or the standard 5 days of 8 hours each.

Paid time off in the U.S. totals about 11 days per year on average, compared to the European Union which required at least 20 days. About two-thirds of U.S. workers would prefer more vacation time. Generous sick time and PTO can help with satisfaction, reduce burnout, and ensure people do not come in while sick. This does require more planning from a production standpoint to ensure operations can still successfully run. Planning should account for only a certain percentage of labor availability based on the number of employees and amount of PTO available. It also requires cross training to ensure multiple people can cover all tasks. Cross training is important beyond just PTO coverage, coverage when someone leaves the company, or if demand increases. Cross training can help counteract boredom, and it allows the possibility for easier troubleshooting or process improvements when people with different experiences and knowledge are able to look at the same problem.

Considering people spend about a third of their life at work, people will move on if they cannot derive satisfaction from their job or find acceptance in the work culture. Many people want to grow and develop, feel they are contributing to the world, but even people who work just to work are going to move on if they are miserable in their job. That is why retention efforts need to focus on a positive work culture as much as pay and benefits.

Managers and management are often cited as the number one reason employees leave a job. When turnover is high, management at all levels must be examined, because while a specific manager might be seeing high turnover, higher level managers and the culture of the company should also be evaluated for their contribution to that manger’s performance and treatment of employees. Lack of advancement, poor work life balance, and toxic culture are key reasons that people leave jobs that managers can have a direct impact on. This feeds back to having a strong mentorship and training program. Mentorships and training can help new managers develop the right skills needed, since management is a very different skill set from most individual contributor roles. Mentorships can also help employees facing issues with their managers, to identify management problems, and how to address them quickly and with the right people.

Company culture is also important related to work life balance, inclusion, and communication. A generous PTO package doesn’t mean much when managers never approve time off, or people are hassled when they use their time. Creating a culture in which taking time off is considered normal and expected can go a long way to creating a positive culture. Good communication is key is creating a positive culture. A recent Gallup Survey on workplace satisfaction shows that companies with higher employment engagement are more successful. It indicates that clarifying work expectations, fostering positive coworker relationships, and providing development all contribute to greater employee engagement and in turn business success. Communication can also help with inclusivity. Growing the labor pool in manufacturing will naturally mean more diversity. Management commitment to ensuring interpersonal problems are dealt with quickly and effectively and having a variety of company events that are accessible and interesting to everyone are basic ways to create an inclusive culture.

Growing, developing, and sustaining the labor pool in manufacturing is not a quick or easy problem to solve but by breaking down the steps and creating programs to encourage engagement, train new talent, and foster a culture to retain employees we can start to combat the labor and skills shortages faced by manufacturing.

Growing the manufacturing labor pool

Part two: Attracting and developing talent

Katelyn Galer, Senior Analyst, Omdia

With the landscape of the workforce changing, dedicated effort is needed for manufacturers to compete in growing their labor pool. Part one of the series covered shifting the appeal of manufacturing, broadening the appeal, and tapping new demographics, with methods like community outreach, and student outreach at high school and secondary level. Part two of the Growing the Talent Pool series will cover attracting and developing talent.

After the manufacturing industry’s misplaced negative perception has shifted and more people are interested in joining the world of manufacturing, actually getting people into jobs is the next step. Vocational training programs have seen a 16% increase in attendance over the last year as traditional universities have experienced continued declines in enrollment since 2010. The growth in vocational training indicates a shift towards trades including manufacturing. Manufacturing should capitalize on this shift by changing hiring criteria, and developing internships and apprenticeships to attract and develop the next wave of talent.

Since the number of job openings in manufacturing is still exceeding the number of people in the field, it is necessary to look beyond those with manufacturing experience. In a recent review of studies, researchers found no significant correlation between prior work experience and job performance. If prior experience cannot predict success, and the number of folks with prior experience is small anyway, the focus must shift to something else. The core skills of what make someone successful are going to be important. Is it problem solving, following processes, speed and agility, digital literacy? What makes a person a good fit for the position? How can you articulate and test those abilities without the specific manufacturing background? This will mean changes to job advertisements, resume reviewing, and interview techniques. Job ads can specify the skills they are looking for and emphasize that prior experience is not needed. Some studies have shown that women are less likely to apply for jobs than men if they do not meet all the criteria, so emphasizing the types of skills needed rather than experience could help attract a broader audience. Since testing for core skills is different than reviewing past experience, new techniques are needed for screening applicants.

One method for securing talent from other industries is a skills assessment, an option many manufacturing companies are offering. These assessments also help by removing unconscious biases in hiring. People often hire people that are like themselves, so having tests can ensure applicants are rated based on skills rather than gut feelings and common interests. But this does require that the skills assessments used are the right measures for a specific role. With the evolving landscape of manufacturing, the addition of AI and more automation will again shift the competencies and experiences that are important. Will mechanical or numerical reasoning become less critical as digital literacy becomes more critical? Truly understanding the roles needed, how they might evolve in the future is critical to determining which skills are important for employees to have.

Bringing on people with the right core skills who lack relevant training means that training programs will need to be more robust. Onboarding new employees may take longer, but focusing on the core skills will ensure new employees’ long-term success and grow the labor pool. These training programs can be important for regular full-time employees, interns and apprentices. A case study from Australia showed that manufacturers that are successfully transitioning to Industry 4.0 have cultures that value learning and education/training.

As anyone just starting out, or changing careers can tell you, it is hard to get a job without experience, and you can’t get experience without a job. Internship and apprenticeship programs are intended to be jobs for people with little or no experience and can benefit both the employee and the employer. With internships, there is typically a short timeline and a specific intent on training. The employee can learn not only about the specific job, but work life in general, as well as learning about the company. The company gets the labor, usually for a lower cost, and can test out employees on a short-term basis to determine if they will be a good fit longer term. In my own experience, my university had “co-ops” (co-operative education) built into the curriculum with a broad range of companies to work with. We got experience creating resumes, interviewing, and three six-month internships before our graduation. This prepared us for work after graduation, and many people went on to work full time at one of the companies they did an internship with. Companies can ensure they are connected to local high schools, community and technical colleges, as well as universities to broadcast their internship opportunities.

Apprenticeships tend to be more structured than internships as they often pair education with job experience and result in a credential or certificate. The demand for apprenticeships is increasing, 75% of respondents to a survey indicated they were interested in paid on the job training. Larger companies can sometimes partner with local community colleges to run their own apprenticeship programs. However, this might not be practical for all companies. It makes sense to partner with non-profits or industry associations that run apprenticeship programs. In the U.S., the government has an apprenticeship website where career seekers, employers, and education partners can learn about applying, joining, and creating apprenticeship opportunities.

Developing an expanded workforce for manufacturing will take effort revolving around realistic hiring criteria and thorough training programs. Next up in the series is focusing on ways to retain that talent.

Resources: Toyota partnered with The Manufacturing Institute to create an Internship Toolkit to help companies better develop their internship opportunities.

AI: The brain powering industrial sustainability

Alex West, Principal IoT Analyst at Omdia, and Andrea Ruotolo, Global Head for Customer Sustainability at Rockwell Automation

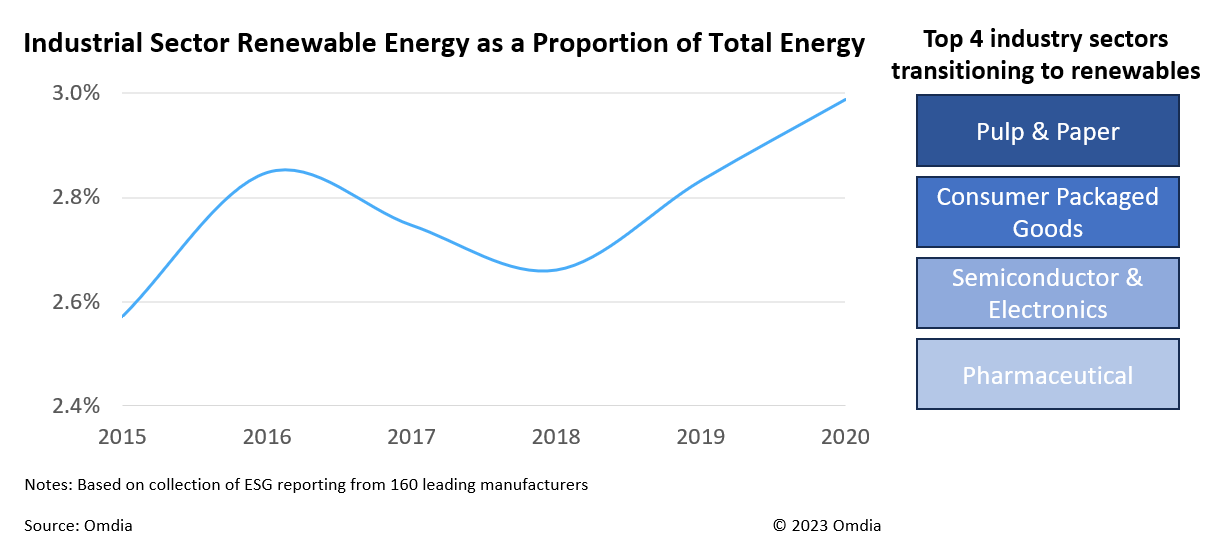

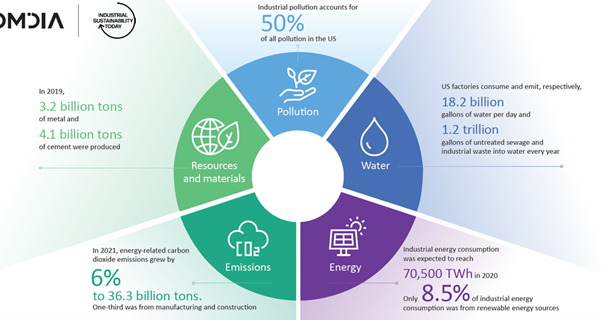

The rapid advancement of AI is revolutionizing various sectors, and its potential to drive sustainability initiatives in the industrial sector is immense. AI acts as the brain behind these efforts, enabling us to analyze vast datasets, identify inefficiencies, and make informed decisions that minimize environmental impact and optimize operations.

AI's Role in Sustainability

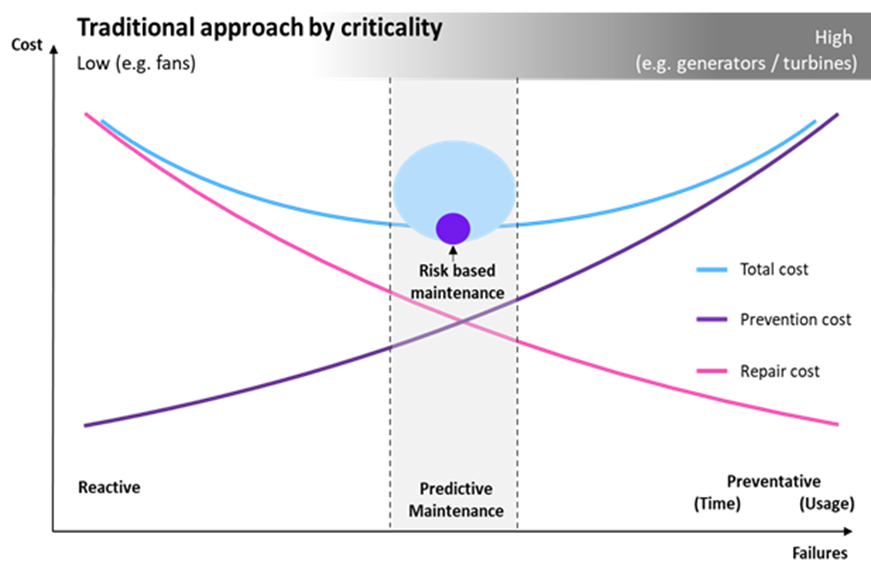

In recent years, AI has transitioned from a theoretical concept to a practical tool, with applications ranging from energy optimization to predictive maintenance. The World Economic Forum estimates AI's potential to reduce global greenhouse gas emissions by approximately 5% by 2030, highlighting its significance in combating climate change. AI is being utilized to optimize supply chains, reducing transportation distances and minimizing emissions. Additionally, according to a report by McKinsey, AI-powered predictive maintenance can reduce machine downtime by up to 50%, leading to increased productivity and resource efficiency.

Real-World Impact

The impact of AI on sustainability is evident across industries. In the automotive sector, Toyota implemented AI-driven quality control systems that reduced scrap rates by 20%, saving costs and preventing material waste. In the energy and utility industry, AI is being leveraged to optimize energy distribution, integrate renewable resources, and improve the prediction of energy generation from solar panels, enabling a more efficient and sustainable energy system.

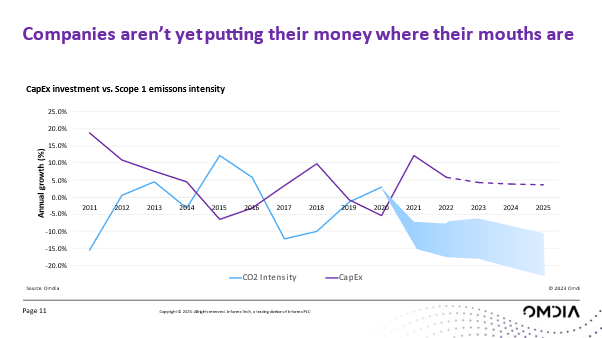

Omdia analysis suggests that less than a quarter of manufacturing companies have scaled AI deployment across multiple facilities, whilst only 30% have implemented a long-term sustainability roadmap.

Overcoming Challenges

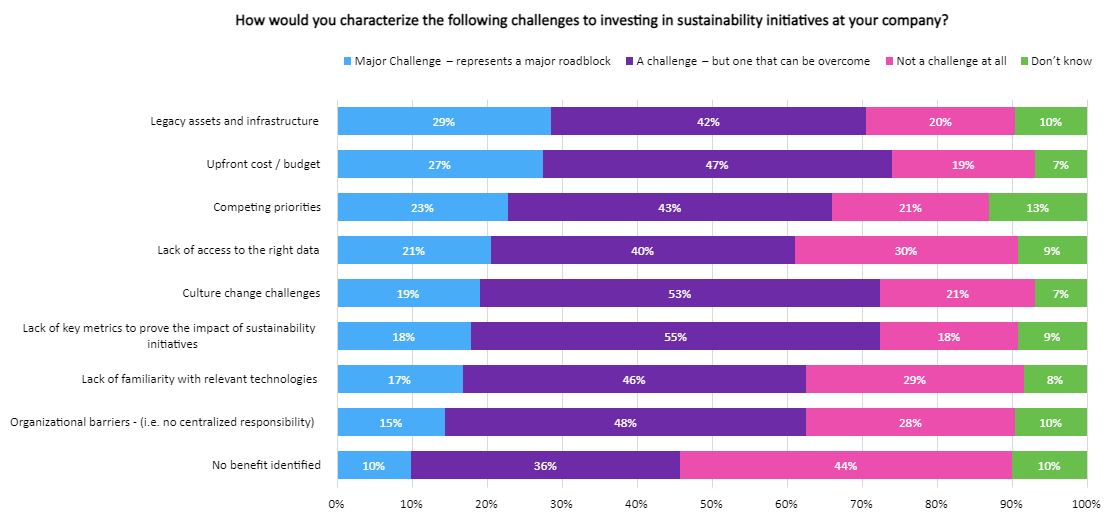

While the benefits of AI for sustainability are clear, challenges remain. One major hurdle is justifying the investment in AI-powered solutions. Both sustainability as a set of applications and AI as a technology are still comparatively new in the industrial sector. Omdia analysis suggests that less than a quarter of manufacturing companies have scaled AI deployment across multiple facilities, whilst only 30% have implemented a long-term sustainability roadmap. Combined with current challenging economic conditions in many regions and sectors, justifying the cost of investment requires clear identification of the benefits.

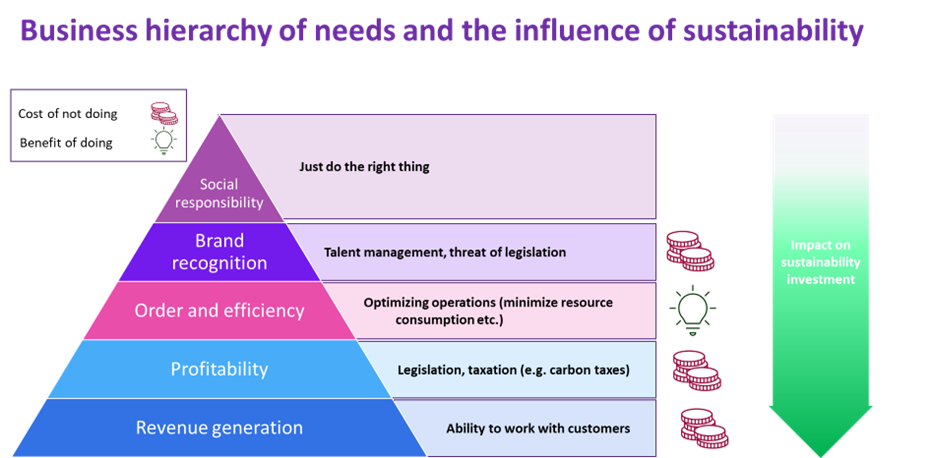

Companies need to focus on both tangible and intangible outcomes, such as cost savings, revenue growth, regulatory compliance, and brand recognition. It's crucial to embed sustainability-specific key performance indicators (KPIs) into reporting and auditing processes to effectively measure and monitor the impact of these initiatives. Additionally, companies need to address concerns related to the energy consumption of AI, particularly with the rise of large language models. Focusing on sustainable AI practices, such as optimizing models and monitoring energy use, is essential to ensure AI's positive impact on sustainability as well as provide companies with the ability to balance environmental impact with productivity and expenditure.

Another challenge lies in ensuring AI systems remain ethical and accountable. Transparency, avoiding bias in algorithms, and data privacy are critical considerations. It's essential to adopt a comprehensive ESG (Environmental, Social, and Governance) framework to evaluate the overall impact of AI implementation, ensuring a truly sustainable future. Addressing potential workforce impacts and ensuring psychological safety during AI adoption are also crucial for successful implementation.

The Road Ahead

Emerging trends at the intersection of AI and sustainability include:

- Optimizing the balance between production, energy consumption, profit and emissions

- AI for a circular economy – whether that’s using to support in the design products with remanufacturing in mind, or tracking, improve logistics infrastructure

- AI is also poised to play a crucial role in waste reduction, recycling processes, and developing eco-friendly products.

Additionally, AI-powered predictive modeling and scenario analysis will enhance risk management and mitigation strategies related to climate change. Advancements in AI, such as generative AI and its creation of synthetic data, will further augment the capabilities of aforementioned opportunities, as well as pave the way for new and more sustainable ways of working.

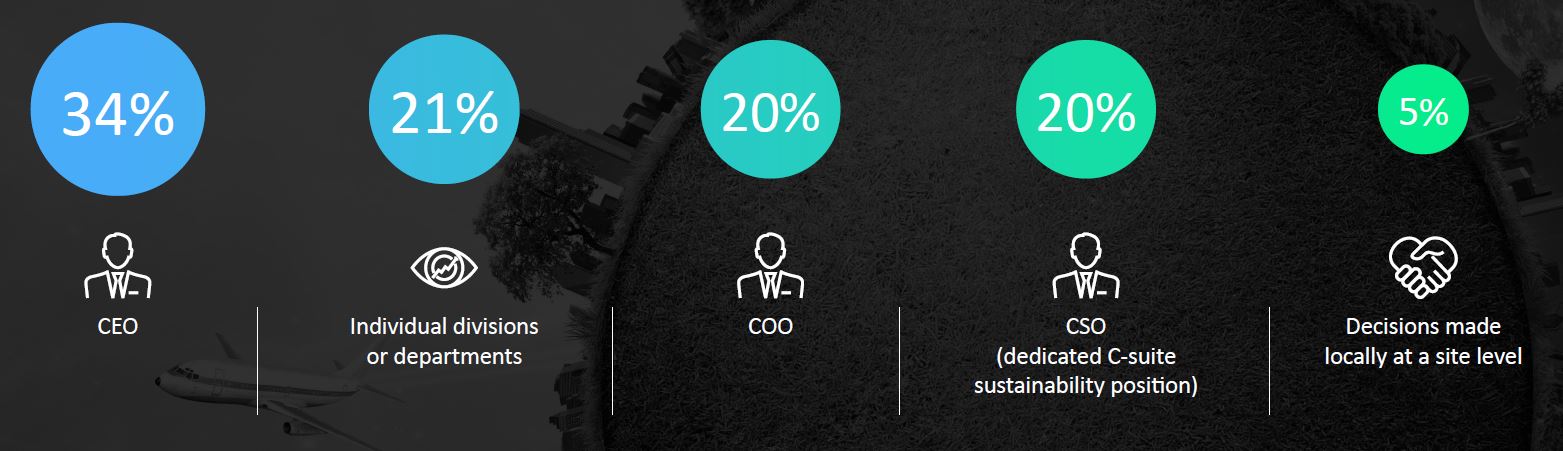

Recommendations for Companies

For companies embarking on this journey, securing unwavering commitment from the C-suite is paramount to secure investment and drive necessary organizational change for both the new technologies and use cases. The integration of AI into sustainability strategies requires leadership from the top, with clear goals, resource allocation, and a culture of innovation. Establishing a clear vision for AI-powered sustainability, aligned with overall business objectives, and communicating it throughout the organization is also crucial. It's equally important to involve the workforce, ensuring they feel safe and empowered to contribute and voice any concerns about AI implementation, as well as consider the broader environmental impacts of decisions made. Setting ambitious yet achievable sustainability targets, is fundamental but also requires companies focus on building a strong data foundation, to help regularly track and record progress against these targets.

Conclusion

AI has the potential to be a powerful force in driving industrial sustainability. By embracing AI technologies, setting clear goals, and fostering collaboration, companies can achieve significant environmental and economic benefits, paving the way for a more sustainable future. The journey towards a greener and more efficient industrial sector requires a strategic shift, and AI is undoubtedly one of the keys to unlocking its full potential.

Growing the manufacturing labor pool

Katelyn Galer, Senior Analyst, Omdia

The landscape of the workforce is changing. Since the pandemic, remote and hybrid work have taken off. The gig economy is booming, drawing in people with flexibility and possibilities. The way we live is also changing. The number of dual income families in the U.S. has doubled since the 1960s. The number of children families are having has decreased; people are waiting longer to marry. College enrollments have been in flux for a long time – currently enrollments are declining, after steep increases from 1970 to 2010. Social media and technology are also impacting how we communicate and socialize.

With so much change, an industry like manufacturing can suffer due to having a reputation for being slow to change or having very demanding and inflexible schedules. But the world hasn’t changed so much that manufacturing is no longer needed. It remains relevant, and the current number of manufacturing job openings in the U.S. is over half a million. So, how can manufacturers compete in growing their labor pool?

This is a three-piece series on how manufacturing can compete and grow its labor pool. The first installment will focus on broadening the appeal and reaching out to the untapped demographics. The second installment will focus on bringing those people into the manufacturing workforce, and the final piece will focus on retention, keeping the talent in the workforce.

Part one: Broadening the appeal

While manufacturing may be slow to change in some respects, major advancements have been made and most manufacturers see digitalization as the pathway forward. The focus on grueling conditions with repetitive work needs to be swayed. With the increasing amount of automation and digitalization, the repetitive front-line work is changing. Showing the real application and the impact of a job can help influence the perception in a positive way. Outreach programs and community involvement are great ways to change perception and attract new audiences to industry.

Across the world, the demographic for manufacturing workers skews older and male. Broadening the manufacturing workforce means appealing to groups outside the current demographic. This leaves the younger generations and women as large primary targets.

Outreach to younger audiences is growing and effective. This can look like partnerships with high schools and local groups to sponsor projects, present to students, and offer factory tours. Partnerships with local groups (like Future Farmers of America, Girl or boy scouts, robotics clubs) provide the opportunity to engage with young people already interested in the field in general, to provide more detail to hopefully grow interest. Presenting the work and some problems and letting the students have a discussion or do a project to try to solve the problem gives real life application to a vague concept and better understanding of the impact of a job.

Competitions are another way that companies can get involved with high schools. FIRST is a non-profit organization that hosts competitions in topics like tech and robotics for high school students. Companies and individuals can be sponsors for teams or volunteers. FIRST has shown that participants are more likely to have STEM majors by their fourth year of college than comparison groups. Specifically, these participants are 3.5x more likely for computer science and 2.5X more likely for engineering. As a way to excite students about manufacturing and engage local companies with students, the Pennsylvania Department of Community and Economic Development sponsors a competition for students to create a video about what is cool about manufacturing and profiling local companies. All of these are ways to get students interested in the industry in general and connected to local companies while they are still working out potential career paths. It is also a great way for companies to show involvement in their local communities.

A recent program planning to launch in Austin, Texas in early 2025 will partner Austin Community College and The University of Texas to create a semiconductor training center, focused on training for the future of the semiconductor industry from technicians to engineers. They are working with industry experts to develop curriculum and credentialling. This is a good example of how companies can work with their local colleges and universities to ensure that training for their specific industry is a priority and focuses on the proper skills and needs.

Rockwell Automation Partners with IISE (Institute of Industrial and Systems Engineer) to host a competition called the IISE/Rockwell Automation Student Simulation Competition. Participants use Rockwell’s simulation software to solve real-world scenarios and winners earn cash prizes. This allows students to see real work examples, demonstrate their abilities, and the winners can also offset some costs of university. Companies can also get involved with secondary education by sponsoring projects or developing research facilities on college campuses. Motorola, for example, has an Innovation Center at Research Park in the University of Illinois. This provides visibility and great opportunities for collaboration, internship, mentorship, and recruitment. Plus, many universities look to partner with corporations for sponsorship and mentoring for engineering capstone projects.

These are all ways that companies can participate in their local communities specifically related to their industry or work. Beyond industry-specific projects, general involvement in the local community is a good way to create visibility and good will toward the company. A recent study showed that over half of Gen Z would reject a job offer if the company did not align with their values. Participating in the local community is a way to demonstrate a company’s values.

Outreach can take many forms, but without shifting the perception and finding ways to pull in more people, manufacturing will continue to struggle to meet its labor needs.

Navigating the evolving landscape of building software and platforms

Ivy Sun, Senior Analyst, Physical Security, Omdia

In the dynamic realm of intelligent buildings, the boundaries between various building platforms are undergoing a significant transformation. As the industry evolves, it's crucial for professionals to understand the emerging trends and market dynamics shaping the future of building software platforms. Omdia’s Building Software Platforms vendor market tracker report aims to provide professionals in the intelligent buildings industry with a detailed overview of key market trends and insights.

Convergence of Building Platforms

Building Automation (BA) vendors are expanding their platforms to include innovative products like asset management and space management, blurring traditional boundaries. Meanwhile, Integrated Workplace Management Systems (IWMS) companies are integrating sustainability applications. Building Energy Management Software (BEMS) suppliers, primarily BA and hardware manufacturers, are enhancing their offerings, while Building IoT platforms exhibit a diverse supplier landscape.

Deployment Strategies and Future Trends

The deployment landscape is evolving, with a preference for on-premises and edge deployment gradually integrating cloud features. Future trends suggest a shift towards outcome-based approaches, tiered offerings, and cloud-native architecture. As platforms become more scalable, a selective verticalization of offerings is anticipated, with a focus on cloud technology and hybrid deployment models.

Insights into Energy Management Software (BEMS) and Building IoT Platforms

Tier 1 and Tier 2 solution providers dominate the BEMS market, with notable players like Siemens, Honeywell, and Johnson Controls leading the way. The EMEA region leads in BEMS adoption, driven by high energy costs and sustainability commitments. While most BEMS deployments are on-premises, edge products are on the rise, bridging the gap between traditional BA systems and cloud-based solutions.

Cloud architecture dominates Building IoT platforms, driven by factors like cost efficiency and scalability. The market remains fragmented, presenting challenges and opportunities for traditional BA vendors. Collaboration between vendors with large computing power and vertical sector expertise is crucial for maximizing value for end customers.

Investment Trends and Innovative Software Solutions:

Investments in smart buildings reflect continued interest, with a focus on IoT solutions integrated into renewable energy and sustainability initiatives. Innovative software solutions, primarily based in North America, cater to diverse needs in asset management and space management. Collaboration and market validation are essential for the successful integration of these solutions into traditional markets.

In conclusion, the intelligent buildings industry is witnessing rapid evolution, driven by technological advancements and changing market dynamics. By staying informed about emerging trends and leveraging insights from reports like ours, professionals can navigate the evolving landscape of building software platforms and unlock new opportunities for innovation and growth.

Manufacturing at the crossroads: How the US election could shape the future of the manufacturing industry

Rachel See, Senior Analyst, Electric Motor Systems, Omdia

Summary

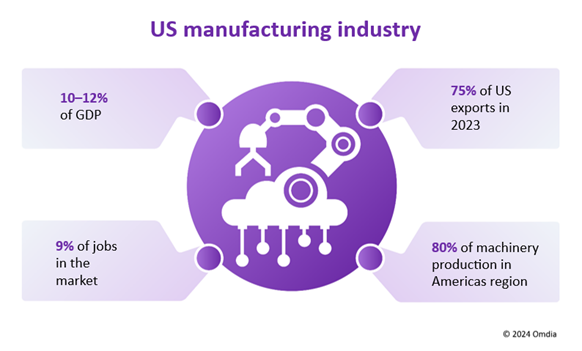

In recent years, investment in R&D and infrastructure has played a critical role in the US manufacturing industry. Overall, US manufacturing has grown largely owing to an emphasis on supply chain resiliency and shifts in trade policies. Additionally, there has been an increased focus on reshoring or nearshoring, sustainability, and innovation to improve competitiveness. However, while the manufacturing purchasing managers index (PMI) has been stable, total employment has declined slightly over the past year, according to the US Bureau of Labor Statistics. Figure 1 provides a snapshot of the US manufacturing industry.

That said, political decisions and policies can significantly impact the country’s manufacturing landscape. With many uncertainties surrounding the upcoming presidential elections, machine builders, their suppliers, and their customers are cautious with investments and their long-term strategies. This article explores the potential impacts of the upcoming US elections on the manufacturing sector.

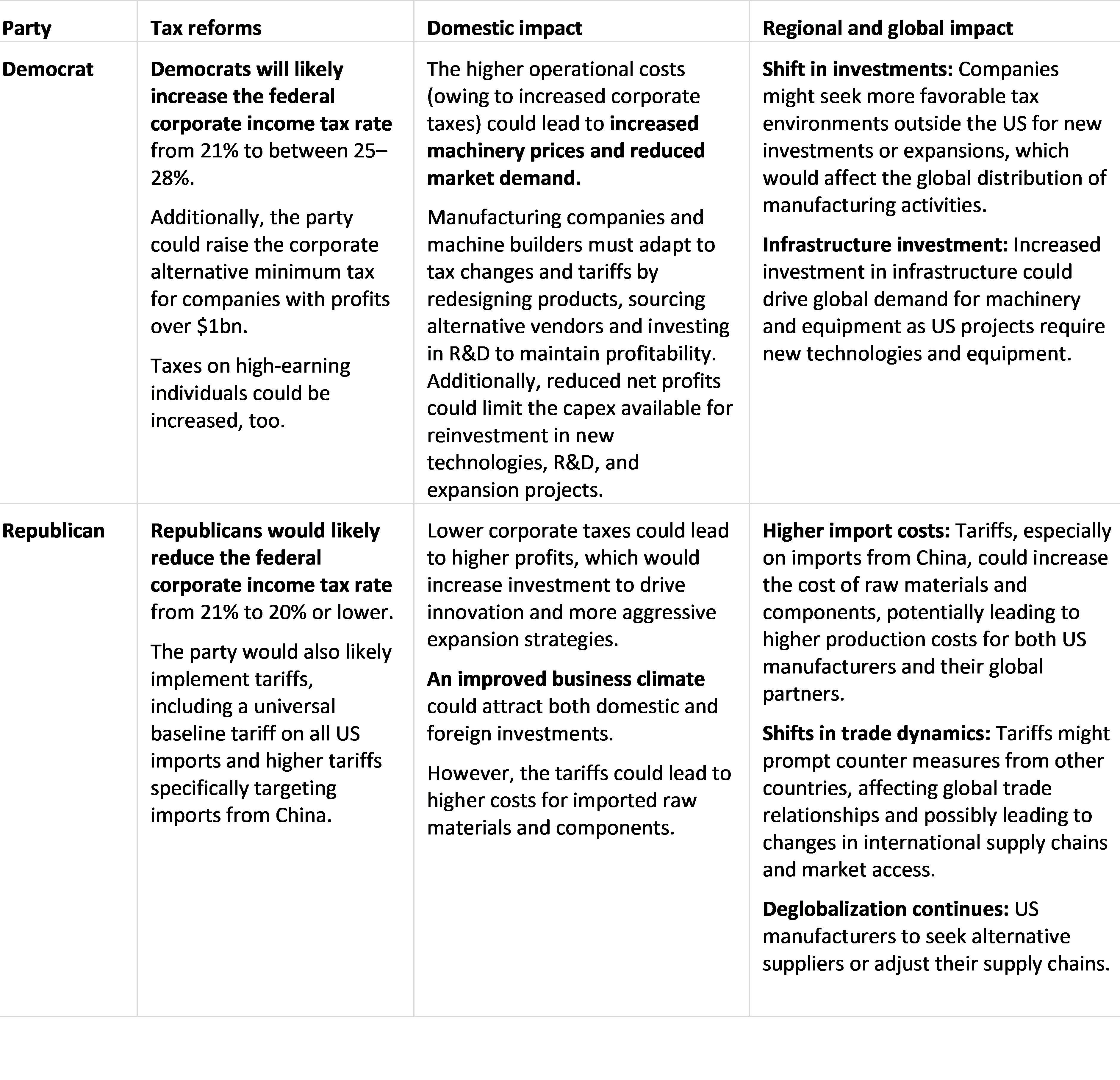

Tax landscape for the manufacturing and machinery production sector

The outcome of the election could substantially change the tax landscape, affecting investments, operational strategies, and market confidence. Table 1 lists the differences between the tax approach that each party will likely take and their implications to domestically and globally.

Table 1: Democrat and Republican tax reforms and their implications

Both parties have made efforts to subsidize the industry by increasing trade barriers, especially against China. Current US president Joe Biden previously hiked tariffs on electric vehicles (EVs) and raw materials, such as aluminum and steel, from China. Additionally, Republican candidate Donald Trump’s “America First” proposal would implement a 10% blanket tariff on all US imports and 60% tax on Chinese goods. These measures could lead to inflationary pressures and risk a manufacturing slowdown, prompting companies to diversify suppliers and build domestic supply chains, which could potentially increase investments in metal and mining in Latin America & the Caribbean. Trade policies will increase the cost of machinery manufacturing because of higher input costs from imported raw materials and components, which would make products more expensive and less competitive. Furthermore, retaliatory tariffs from other countries could further reduce export opportunities for machinery producers.

Sustainability in manufacturing: A shift in priorities

Environmental regulations in the US could be significantly influenced by the outcome of the elections, seeing as the two major political parties generally have different approaches, as shown in Table 2.

Table 2: Democrat and Republican environment regulations and their implications

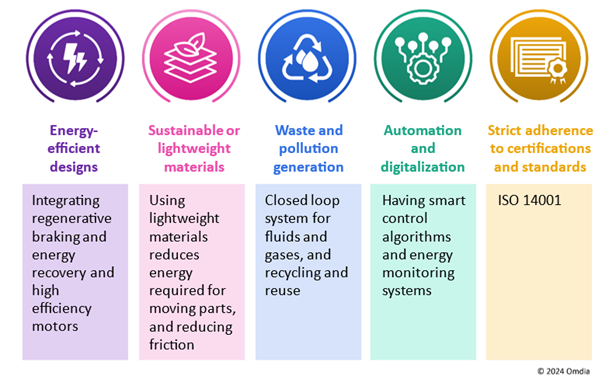

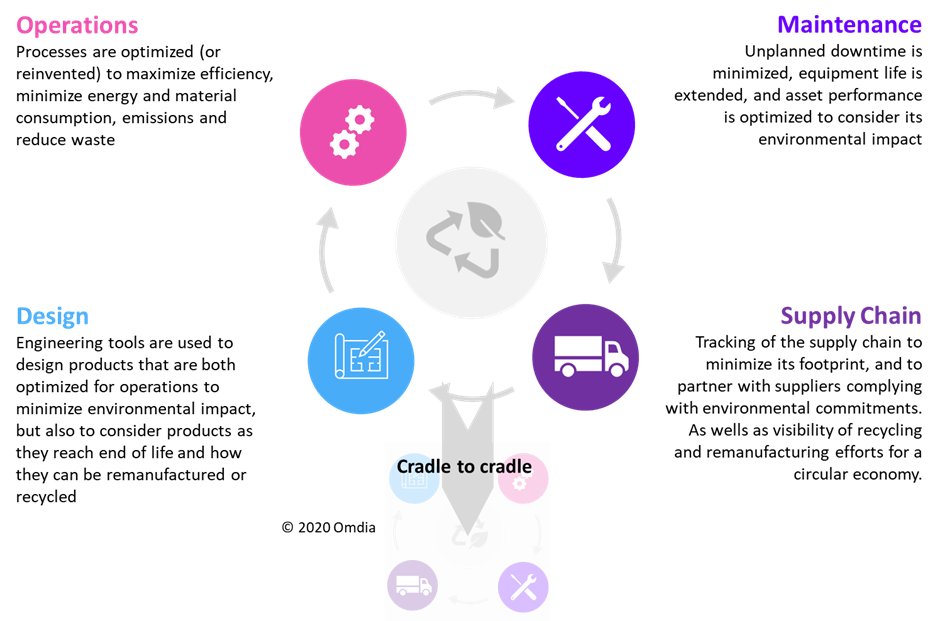

The result of the elections may cause machine builders’ and manufacturers’ priorities to shift, which would change the demand for industrial automation products with higher technology specifications and better energy-efficiency. Figure 2 shows some of the implementations and considerations of machine builders when it comes to sustainability.

Figure 2: Machine builders' approach to sustainability

Labor and immigration policies

The US is currently facing a labor and skilled workforce shortage, especially in expanding industries, such as the semiconductor and electronics market. If labor shortages persist, Omdia expects a transformation in the industry, reshaping technology adoption to reduce reliance on labor.

Elections-wise, a Republican win would likely lead to increasingly tight immigration policies. Tighter labor regulations could dampen the labor supply, increase labor costs, and limit innovation and growth for machine builders, which could also impact foreign investors’ interest in entering the US market. On the other hand, the impact could be the opposite if the Democrats take the office.

Infrastructure: A bipartisan consensus

While the Democrat and Republican parties contrast varyingly with their stances on trade, environment, and labor and immigration, both have somewhat similar takes on infrastructure. Therefore, regardless of the outcome of the election, the Infrastructure Investment and Jobs Act (IIJA) and CHIPS and Science Act are likely to remain intact; both acts are expected to not face any rollbacks regardless of which party wins.

The CHIPS Act is important for semiconductor R&D and manufacturing, which has become a national security issue owing to geopolitical tensions with China and the risk of supply chain disruptions. As such, the act is expected to continue supporting infrastructure investment through incentives for US-based semiconductor production. Funding from the act has incentivized semiconductor companies, such as Intel, GlobalWafers, and Texas Instruments to build new plants in Ohio, Texas, and Utah, respectively. Additionally, TSMC and Samsung are expected to start building their manufacturing plants in 2024 in Arizona and Texas, respectively.

Continuous investment in the semiconductor industry aimed at easing supply chain vulnerabilities amid geopolitical tensions will lead to a positive regional and global impact. Manufacturers that need chips to produce their equipment can do so with improved productivity knowing that their supply networks are secure, which is a key feature to attract manufacturing investment and build a more resilient supply chain.

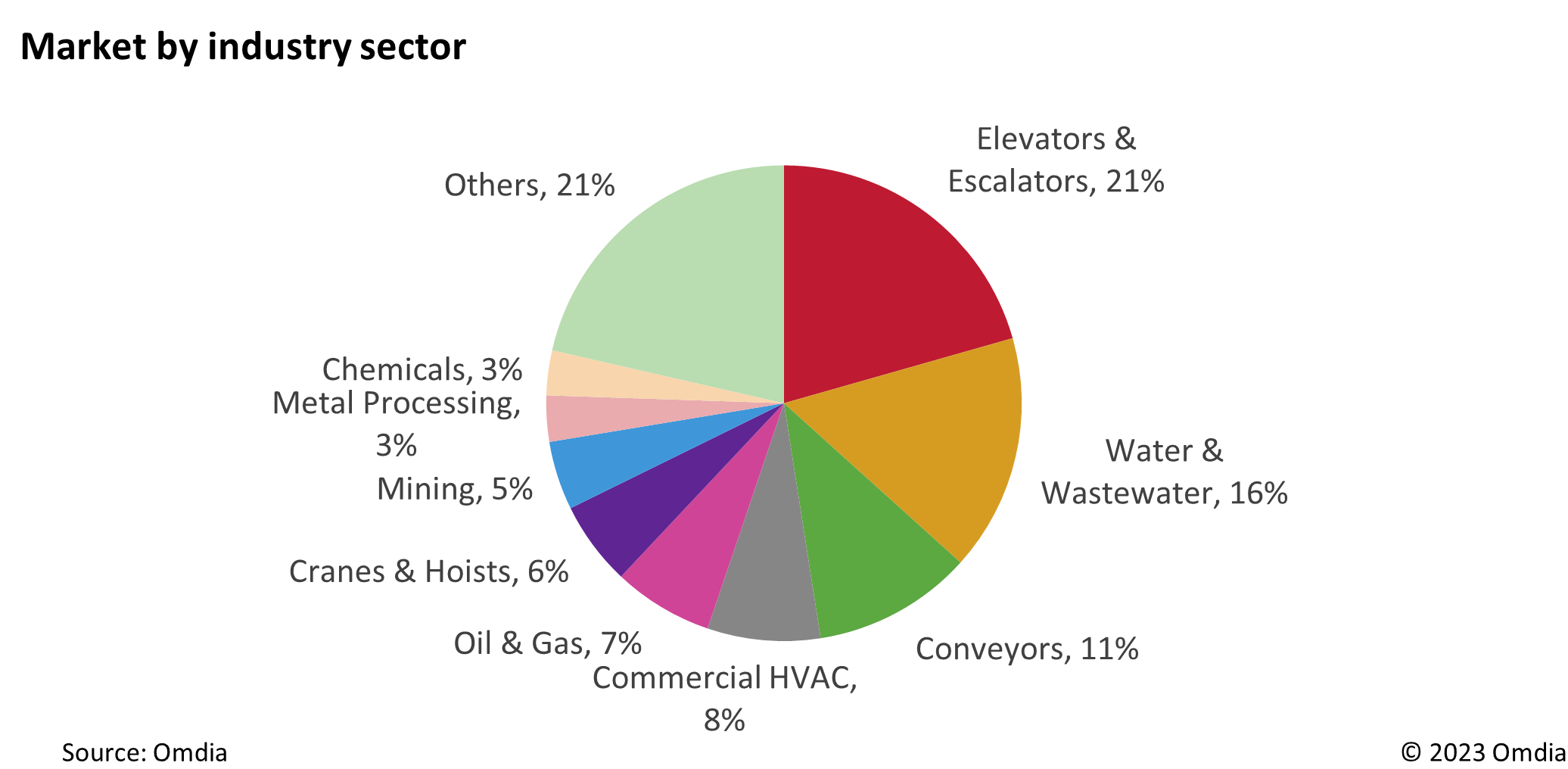

These developments will stimulate growth in the building automation, commercial HVAC, and elevators and escalators sectors. With increased semiconductor manufacturing and other manufacturing industries in the US, warehousing and logistics are also expected to be bright spots in the market in the coming years, with increasing need for materials handling equipment, such as conveyors, cranes, and hoists.

Conclusion

The outcome of the 2024 US election has the potential to significantly impact the global competitiveness of US manufacturing through changes in trade, tax, regulation, and investment policies.

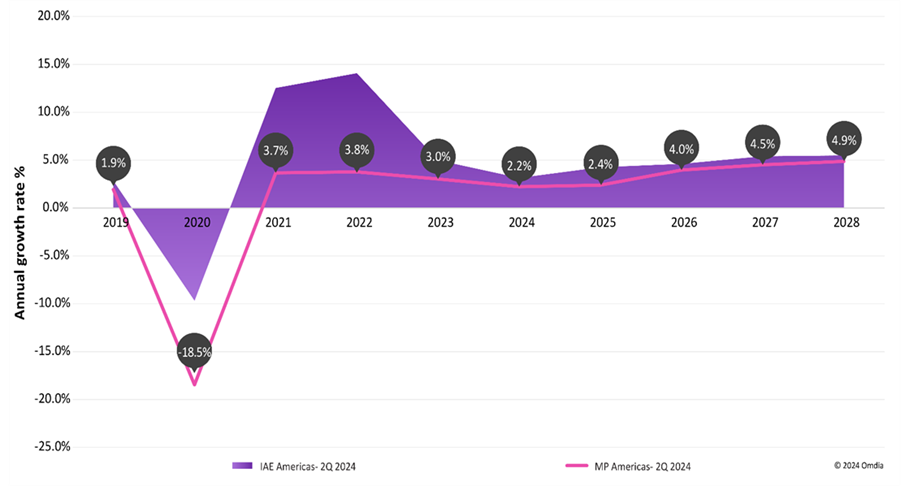

Following COVID-19, the Americas’ market rebounded because of panic buying and investments in infrastructure and the semiconductor industry that were brought on by supply chain constraints. There was also increased activity in the oil and gas sector, particularly during the Russia–Ukraine conflict. Additionally, nearshoring and reshoring investment trends have continued to drive significant growth of certain sectors in North America. Although the manufacturing sector has faced headwinds in 2024 largely owing to inventory rebalancing, recovery is forecast from 2025 onwards, as shown in Figure 3. Recovery is expected as long as US companies continue to benefit from nearshoring and reshoring trends and intensify their focus on supply chain security for critical components and minerals, the latter of which would drive the growth of industrial automation equipment and machinery markets.

Figure 3: An overview of industrial automation equipment (IAE) and machinery production (MP) in the Americas

Appendix

Further reading

The Employment Situation – July 2024, U.S. Bureau of Labor Statistics (retrieved August 2024)

Author

Rachel See, Senior Research Analyst, Manufacturing Technology

Citation Policy

Request external citation and usage of Omdia research and data via citations@omdia.com.

Omdia Consulting

We hope that this analysis will help you make informed and imaginative business decisions. If you have further requirements, Omdia’s consulting team may be able to help you. For more information about Omdia’s consulting capabilities, please contact us directly at consulting@omdia.com.

Copyright notice and disclaimer

The Omdia research, data and information referenced herein (the “Omdia Materials”) are the copyrighted property of Informa Tech and its subsidiaries or affiliates (together “Informa Tech”) or its third party data providers and represent data, research, opinions, or viewpoints published by Informa Tech, and are not representations of fact.

The Omdia Materials reflect information and opinions from the original publication date and not from the date of this document. The information and opinions expressed in the Omdia Materials are subject to change without notice and Informa Tech does not have any duty or responsibility to update the Omdia Materials or this publication as a result.

Omdia Materials are delivered on an “as-is” and “as-available” basis. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information, opinions, and conclusions contained in Omdia Materials.

To the maximum extent permitted by law, Informa Tech and its affiliates, officers, directors, employees, agents, and third party data providers disclaim any liability (including, without limitation, any liability arising from fault or negligence) as to the accuracy or completeness or use of the Omdia Materials. Informa Tech will not, under any circumstance whatsoever, be liable for any trading, investment, commercial, or other decisions based on or made in reliance of the Omdia Materials.

Carbon capture and the industrial sector

Jackie Park, Editor

The International Energy Agency defines carbon capture, utilization and storage as, “the capture of CO2, generally from large point sources like power generation or industrial facilities that use either fossil fuels or biomass as fuel.” If the CO2 isn’t used onsite, it can be compressed and transported for other applications like fertilizer and soda. What opportunities can this technology provide manufacturers?

This technology is essential for achieving climate goals according to the Intergovernmental Panel on Climate Change, or the IPCC. That group claims that to achieve the goals set in the Paris Agreement and limit future temperature increases, we need to use technologies that remove CO2 from the atmosphere, making carbon capture an essential part of that mission. Carbon capture technologies are expected to continue growing rapidly, valued at $3.28 billion in 2022 the market is expected to grow at a compound annual growth rate of 6.2% from 2023 to 2030.

How can carbon capture help the industrial sector?

Carbon capture provides an important tool for companies looking to achieve their sustainability goals without changing their entire manufacturing process. According to the Center for Climate and Energy Solutions, carbon capture technologies could reduce global greenhouse gas emissions by 14% by 2050, if executed effectively. Every bit helps to achieve global goals for reducing emissions.

Carbon capture also provides a unique opportunity for financial benefits through the Inflation Reduction Act, the largest governmental support for carbon capture to date. According to the Center for Climate and Energy Solutions, this act extended the “commence construction” window through 2032, added a “direct pay” option for the first five years of a tax credit, and enhanced the value of tax credits for industrial and power generating facilities.

Current and future technologies

Nearly all carbon capture happening today comes from natural methods: 99.9%, actually. Reforestation and improved forest management are carrying the heavy weight of removing carbon from the atmosphere and these methods would need to double in the next six years to stay on track. This means new technologies specializing in carbon capture are essential to achieving emissions reduction goals.

Start-up CarbonCapture created DAC units, or direct air capture units. These shipping container-sized units can capture over 500 tons of carbon dioxide each year via solid sorbents that soak up CO2 when cooled and release it when heated. The carbon dioxide that these units capture is either stored underground permanently or used to make sustainable fuels and other industrial products.

Another step to the carbon capture process is reusing the carbon to create other materials. One way this is being done is with post-combustion capture, which is, “a technology that separates and selectively enriches CO2 from the flue gas emitted by combustion equipment using physical and chemical methods,” according to ScienceDirect. Start-up LanzaTech’s solutions transform carbon into materials that directly replace virgin fossil carbon in consumer goods and sustainable aviation fuel.

Other projects are on the way, with 30 commercial-scale carbon capture projects currently operating worldwide, 11 projects under construction, and 153 in other stages of development according to the Center for Climate and Energy Solutions.

A look at industrial symbiosis

Jackie Park, Editor

Companies looking to reduce emissions and embrace sustainability initiatives at a lower price tag might consider working with their peers. Industrial symbiosis empowers manufacturers and other industries to work together to offset emissions and trade or pass on machinery, waste, and more to one another to reduce emissions.

What is industrial symbiosis?

The European Circular Economy Stakeholder Platform defines industrial symbiosis as, “the use by one company or sector of underutilized resources broadly defined (including waste, by-products, residues, energy, water, logistics, capacity, expertise, equipment and materials) from another, with the result of keeping resources in productive use for longer.”

Industrial symbiosis is more than an idea – the European Union wrote it into law in 2018, and member states must practice industrial symbiosis whenever possible.

Industrial clusters

Industrial clusters provide the perfect opportunity for industrial symbiosis. Industrial clusters are defined as “geographic areas where co-located companies provide opportunities for scale, sharing of risk/resources, aggregation and optimization of demand,” according to the World Economic Forum. Public-private partnerships are key to the success of industrial clusters. Private funding may get similar projects off the ground while government funding may step in to help companies achieve sustainability goals and in the form of tax credits and other subsidies.

Technologies

Industrial clusters are the ideal space to experiment with renewable technologies like carbon capture and cleaner hydrogen production that contribute to industrial symbiosis. According to the International Energy Agency, energy efficiency plays a key role in the transition to net-zero, with a goal of less than 40% of CO2e abatement by 2040 along with the need for 200 Mt of clean hydrogen by 2030 to achieve net-zero.

In addition to carbon capture and clean hydrogen production, industrial clusters are home to recycling programs that help byproducts and waste find new homes and stay in the economy longer. Many industrial materials make for great recycled materials, like fly and bottom ash, boiler slag, and flue gas desulfurization material which can be recycled in Portland cement and concrete, flowable and structural fill, and wallboard.

Barriers

There are several barriers keeping industrial symbiosis from the limelight. First, not all industries are a good “fit” for the process, in which byproducts might need to be shared with another manufacturer. In this situation, it is important that the two industries have a link. For example, the Tianjin Economic-Technological Development Area in China is home to industries like high-end manufacturing, information technology, new information sources, chemical materials, and healthcare. This industrial cluster participates in several resource recycling projects for its industries among other sustainability technologies like carbon capture.

Beyond cross-industry barriers, financial barriers stand in the way, too. Governments and private companies are interested in the success of these areas, but there are just a few real-world examples to point to, making their feasibility limited at times.

Finally, industries must be willing to work together. It sounds simple, but businesses are used to competition, not teamwork. While it’s natural to want to be the “best,” achieving sustainability targets frequently is a team sport in which it’s better to combine resources for the best result.

Is green hydrogen the future?

Jackie Park, Editor

Green hydrogen is creating the opportunity for a much smaller emissions footprint for manufacturers, the auto sector, and more. This clean alternative to fossil fuels is simple to produce and equipment needed to create it is becoming more widely available. Plus, governments see the potential in green hydrogen, providing subsidies and other financial incentives to use this alternative energy. So, what’s standing in the way of its success?

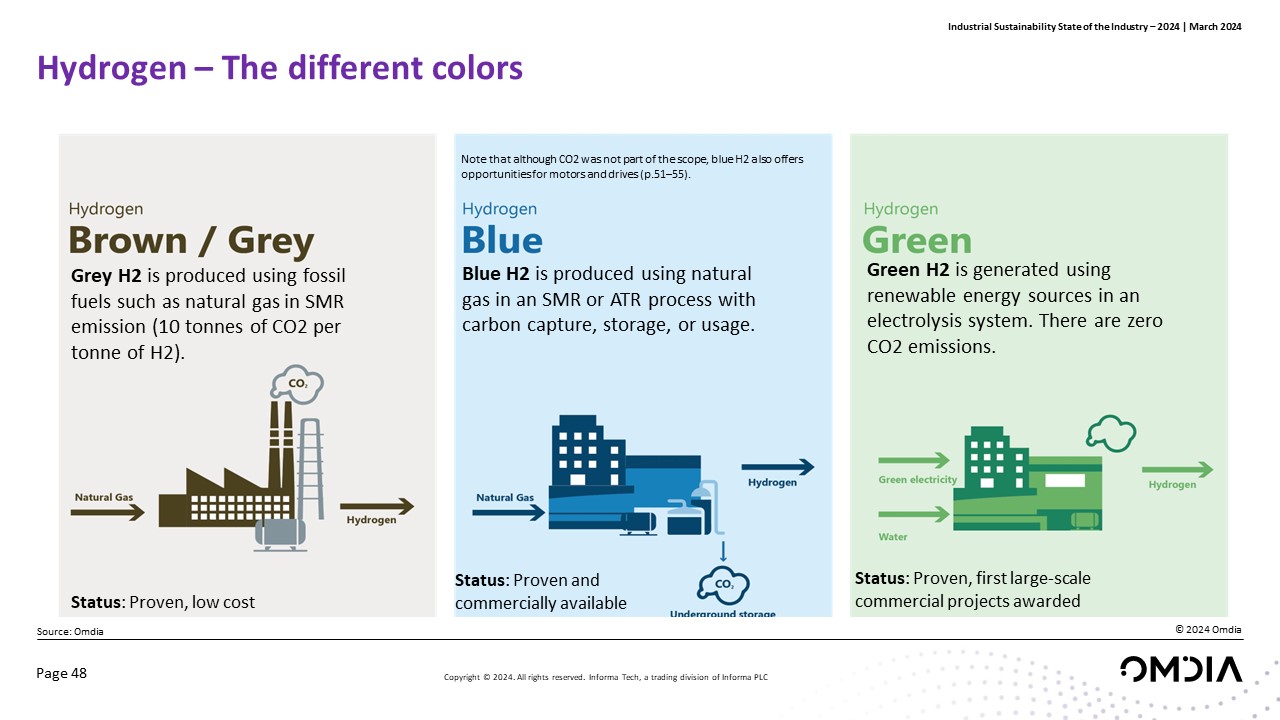

What is green hydrogen?

Hydrogen is a low-emission alternative to fossil fuels, and green hydrogen is the “cleanest” among the ways hydrogen can be produced. This abundant element is produced through electrolysis in which water is electrified and split into hydrogen and oxygen – a process that features little-to-no emissions.

Brown/gray hydrogen and blue hydrogen are other alternatives to creating hydrogen power, but these processes frequently use fossil fuels or carbon capture after the fact, meaning they emit more pollutants during the creation process or release pollutants and capture them later.

Growth for green hydrogen

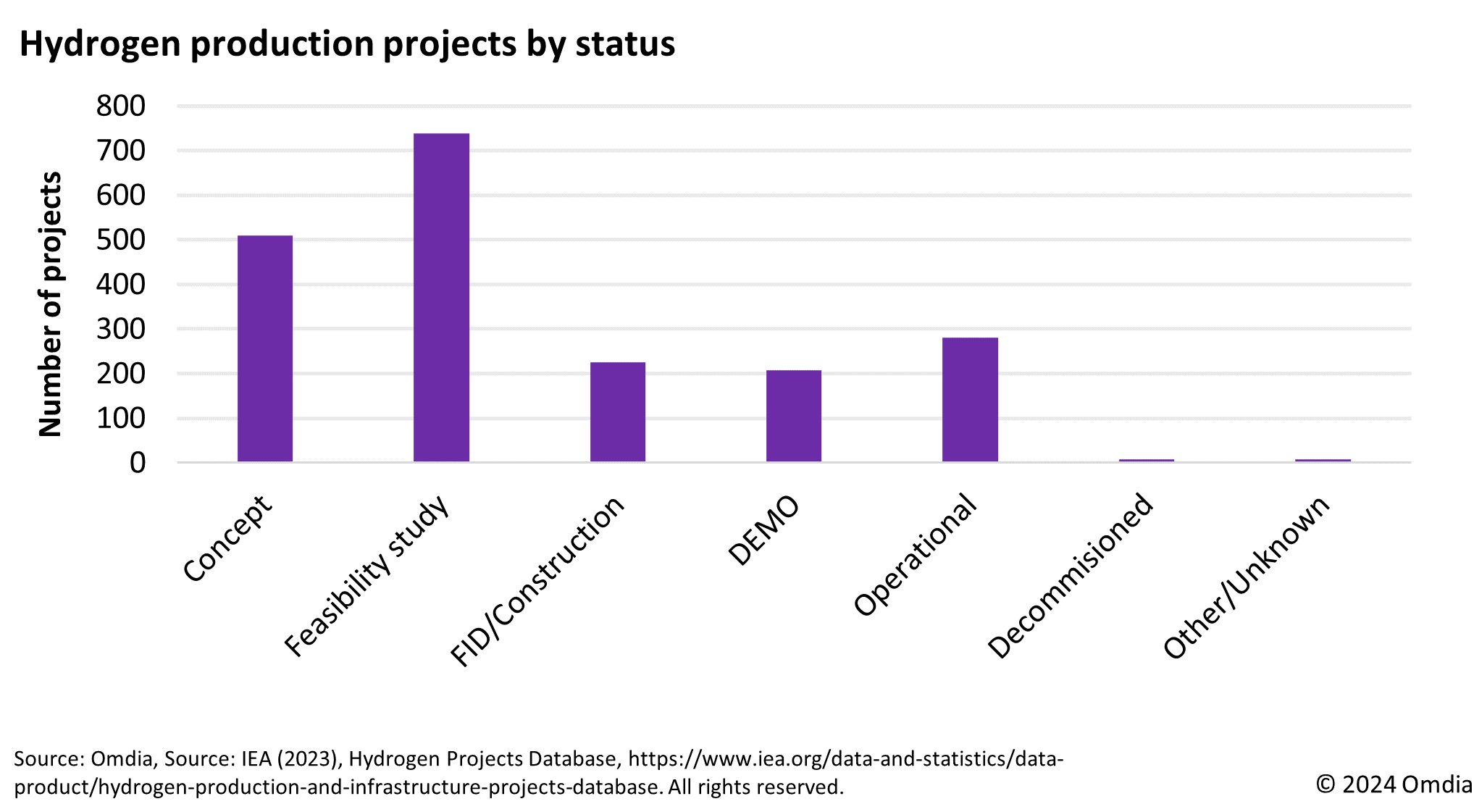

Projects planning green hydrogen use are on the rise. According to the IEA, hydrogen demand in 2021 was at 94 million tons (Mt), and demand mostly comes from the refining and industrial sectors. The demand for new applications such as steel, transportation, and power industries grew by 60% in 2021 compared with 2020. Many of these projects are still in the “concept” and “feasibility study” phases, but this year is expected to be a boom year for projects coming online, according to the IEA.

In addition to planned projects, the proportion of blue and green hydrogen produced compared to gray hydrogen is also expected to increase as more environmental regulations come into effect inspired by the Paris Agreement and other mandatory government emissions reporting standards.

Barriers to entry

Green hydrogen provides a great opportunity for companies to lower their footprint through energy use in manufacturing and transportation. However, cost and infrastructure may stand in the way of this technology reaching its full potential. Producing hydrogen from a low-carbon source is expensive. In fact, right now, it can cost up to three times as much to produce green hydrogen than it does to produce gray hydrogen. However, as the process grows in popularity, scaling it up should bring the price down based on economies of scale.

Infrastructure is another issue – hydrogen infrastructure development is slow and holds back more widespread adoption. However, governmental funding is on the way or in progress in many countries like the United States. In addition to bills introduced, momentum is gaining in actions in the United States and elsewhere across the globe. The Inflation Reduction Act provides tax credits to companies creating new clean hydrogen projects in the country among other clean energy credits. Beyond the U.S., the EU approved 6.9 billion euros in state aid to support infrastructure for clean hydrogen.

Opportunities for the future

According to The World Economic Forum, current hydrogen production needs to be decarbonized and scaled to around six times what it is today to achieve net-zero emissions by 2050. Efforts are in the works to achieve this, but more funding and momentum needs to come about to reach net-zero targets globally.

Explore: Circular economy and the manufacturing sector

Jackie Park, Editor

As companies respond to growing calls for sustainable manufacturing practices and utilizing recycled materials, the idea of circular economy has come to light. Taking back older versions of your product and remanufacturing them seems like the perfect solution, right? It sounds great, but complications related to shipping, how products are produced in the first place, and other logistical details stand in the way of a perfect model. Read on to learn about the current state of play for the manufacturing industry’s attempt at circular economy.

What is a circular economy?

According to the U.S. Environmental Protection Agency, a circular economy “keeps materials and products in circulation for as long possible.” This involves planning ahead: designing products that can later be updated, eliminating waste in the production process, and keeping products of high quality for as long as possible. What a circular economy isn’t? Planned obsolescence. Circularity is all about creating quality products that can be revamped rather than retired.

What challenges does circularity present and how are manufacturers tackling them?

Circularity is great as a concept, but tricky to navigate in practice.

Digital product passports

Manufacturers interested in implementing a strategy for circularity must first consider a digital product passport. This would provide details to all parties in a transaction with information about a particular product’s origin, materials, durability, weight, and more.

These solutions are in the early stages now, but many companies are producing standard digital product passports to begin their journey to circularity. For example, Circularise creates digital product passports that allow companies to track their products along the supply chain and ensure they meet regulatory requirements. These passports also empower companies to track their impact on the environment as a product moves from producer to consumer.

Supplier relationships

Relationships are important, but what if it’s more sustainable to rework a product locally rather than use a longstanding supplier relationship? Circularity brings these questions to the forefront and asks manufacturers to consider what may work best for them. Most decisions come down to budget. However, spending a little bit more for a sustainable, local producer or transportation partner might allow some companies to meet emissions requirements and other new sustainable standards.

Model for takebacks

Developing a new process for anything takes time and patience. The same is true for taking back and retrofitting products. Companies looking to take part in circularity will need to think about:

- Serial numbers

- Model numbers

- Which products will be retrofitted and when

- How products will be transported from customer to producer and back again

- Whether there is a cost to customers associated with retrofitting products

- If companies will give customers new products in exchange for older ones or will retrofit old ones

- Scheduling time in a production facility to perform retrofitting

The list goes on. There’s a lot to consider, but it’s possible to accomplish. Take Patagonia, for example. Its reselling structure sells old products in good condition in exchange for credit toward a future purchase and is a successful trade-in model for the retailer. These steps put Patagonia in a better position toward achieving its goals of net-zero.

How current products are manufactured

Understanding how to build products that can be retrofitted in the future is another essential part of circularity. For example, instead of gluing in components, consider screws or another method that can be dismantled and revamped later on down the line.

What’s next?

Manufacturers have a wealth of opportunities available when they decide to commit to circularity. Some may enter the game early and get a jump on the competition while others may sit back and watch how their peers tackle the issue. In any case, this is a movement that is growing in popularity and importance and will become more essential to take advantage of as time goes on. Plus, new regulations and government programs will bring innovation to the idea of circularity.

Free Event Recap: Hannover Messe 2024

The Analyst Team, Manufacturing Technology, Omdia

The latest in electrification, digitization, and automation for high-performance solutions and carbon neutrality. Strong international presence; slight dip in attendance; Chinese participation rebounded but not to pre-pandemic levels.

Accelerating battery recycling in the US

Zara Fennell, Senior Analyst, Manufacturing Technology, Omdia

The U.S. is undergoing a rapid expansion in battery demand, driven by the growing adoption of electric vehicles (EVs), energy storage systems, and consumer electronics. While batteries are a key puzzle piece in carbon emission reduction, they do come with their own set of challenges related to resource depletion and environmental pollution. Battery recycling is crucial for mitigating these obstacles, but the industry faces technological limitations and inadequate infrastructure. The Inflation Reduction Act (IRA) also stipulates that by 2027, 80% of the value of critical minerals in EV batteries must be either process or mined in North America or countries with free trade agreements with the US, and by 2029, 100% of the value of the components in a battery must be manufactured or assembled in North America. This further underlines the urgency for the development of battery recycling technology in the U.S.

This challenge provides opportunities for automation equipment and industrial software suppliers.

Systems evaluating a battery’s state of health are typically used late in the process once batteries are already at a recycling facility, resulting in still serviceable batteries being broken down, rather than going to second-use. There is a common misconception amongst those outside of the industry that after its first use cycle a battery is ineffective, but the reality is that batteries can retain up to 80% of capacity, and can be deployed in stationary energy storage. Companies offering smart and efficient solutions to sorting centers represent a significant investment opportunity as this market is poised for significant growth.

Digital twin is also deployed further in the recycling process, typically in battery disassembly, allowing for the troubleshooting of systematic errors and the identification of limitations within existing factory infrastructure. Integrating this technology with machine learning may further improve the accuracy and efficiency of recycling, allowing for increased material extraction.

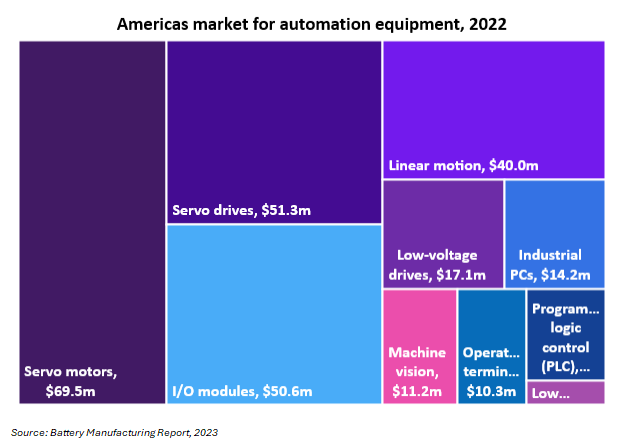

On the automation equipment side suppliers have a unique opportunity to drive innovation and efficiency by developing tailored automation solutions for battery recyclers in North America. Advanced automated technologies such as sorting systems, robotic arms, handling systems, and inspection systems are necessary for improving the process. This demand is evidenced in Omdia’s Battery Manufacturing report, where servo motors and drives made up 44% of automation equipment sold to the battery manufacturing market in North America. Servo motors and drives are forecast for the most growth across the forecast with CAGRs of 15.6% and 15.4% from 2022 to 2027.

As the demand for batteries continues to grow in North America, battery recycling becomes increasingly critical for conserving resources and reducing environmental impact. Addressing the challenges of battery recycling requires collaborative efforts and innovative solutions from all stakeholders, including automation equipment and industrial software suppliers. By leveraging automation technologies to optimize recycling processes and enhance resource recovery rates, suppliers can play a key role in building a more sustainable and resilient battery recycling infrastructure across the United States.

Overcome sustainability challenges as a Digital Enterprise

Siemens Digital Industries

To overcome resource scarcity, meet emissions targets, and exceed customer expectations, industrial businesses are steadily increasing their environmental consciousness. But doing so cannot come at the cost of market competition. Businesses need to continue to produce better products both faster and more profitably. The companies best set to succeed are doing so holistically and from the very start of their development processes.

Technology drives sustainability

The way we manage the challenges arising around us today will have a profound impact on our collective future. Reaching these goals requires a systematic approach to building sustainability as a competitive advantage, and this means integrating technology and data from the very beginning of the development stage. The key to success is a holistic approach focused on transformation of the entire product and production lifecycles and long-term value creation.

Digitalization and automation are game-changers

To address sustainability as an additional requirement alongside the more traditional drivers of profitability and growth, digitalization and automation are critical. By seamlessly combining the real and digital worlds and leveraging the infinite amount of data available in today’s modern industrial environments, businesses can create transparency over their environmental footprint today, where improvements are needed, and how to reach decarbonization and resource efficiency goals in the future. This paves the way for companies to become sustainable Digital Enterprises while staying competitive and resilient.

The comprehensive Digital Twin is a key building block

Few businesses are vertically integrated, which makes collaboration with the value chain another critical endeavor. The comprehensive Digital Twin makes it possible to seamlessly integrate and digitalize entire life cycles. Businesses can connect data from the earliest stages of requirement management and design through production, use, all the way to the end of life. Through a digital thread, businesses can gain additional transparency over their supply chains and ecosystems, including vendors, customers, and end-users. Sustainability data can be automatically collected so that ecosystem members have insight into the discrete inputs that comprise the total impact of a product’s design, manufacturing, use and disposal. This provides a holistic view of sustainability and can reduce scope 1, 2 and 3 emissions.

Siemens EcoTech to help make buying decisions easier

To increase transparency across the whole lifecycle, the products industrial businesses choose for their operations also need to be taken into consideration. Decision-makers need to learn how products are manufactured, what materials are being used, how energy efficient they are, and how they find their way back into the material cycle. Siemens EcoTech is providing a new framework designed to make it easier to identify and compare more sustainable products, which can help them in their buying decision. All of these products are manufactured in facilities using 100% renewable electricity, comply with substances regulations, and provide environmental transparency through the International Environmental Production Declarations (EPD) System. These insights form the basis of the mandatory Siemens EcoTech Profile (SEP), a product data sheet on the product’s comparable performance. By making these SEPs available to the public, decision-makers have holistic transparency on how products fulfill the respective label requirements. This can promote trust in the technologies manufacturers use in their operations and drive sustainability along the value chain.

By leveraging digital technologies and fostering innovation across industries, partners, and developers with platforms like Siemens Xcelerator, companies can transform easier, faster, and at scale. You, too, can take charge of your data to understand the carbon intensity and resource utilization up and down the value chain, as well as ensure worker and product safety. With these data insights, you can make smarter decisions for a more sustainable future. These decisions will not only help you satisfy disclosure requirements and compliance targets, but will ultimately lead to reduced operational costs, increased efficiency, advantages over existing competitors, and opportunities to enter new markets.

To learn more about Siemens' sustainability offerings for industry, visit this website or join us at Hannover Messe 2024.

Start- and Scale-up of the Week: Tyromer

Tell us about your company.

Tyromer helps turn old tires back into new tires and other high-value rubber products. Through a process called devulcanization, Tyromer refreshes End-of-Life (scrap) tire rubber so it can be re-mixed and re-used in manufacturing again. We’ve been supplying into the tire industry for about 7 years and work with the majority of the world’s top tire manufacturers to varying degrees.

The company was founded in 2009 and is based on a technology developed at the University of Waterloo, about an hour west of Toronto, Canada. We currently have a facility in Canada, a facility in The Netherlands, and facilities being built in Chennai, India and in Ohio, USA. Tyromer is working to create a global network of partners through our licensing business model.

Why is the technology your company works on important to the future?

Devulcanization offers the most direct route to tire-to-tire recycling. Using devulcanized material will allow for new rubber product manufacturing with 15, 20, or even 25%+ recycled rubber compound. As about 50% of global scrap tires are still simply burned for fuel value, devulcanization allows the utmost value to be extracted from old tires.

Further, Tyromer’s technology is key to tire manufacturers’ Extended Producer Responsibility (EPR). EPR is a scheme in which manufacturers must help deal with the products they sell at the end of their usable lives. In the tire industry, that means recycling tires and finding new uses for them. Historically end-of-life tires have needed to be ground up into playground mulch, rubber mats, or other simple products. But with devulcanization, old tires can be turned into things like new tires, new conveyor belts, and other rubber molded goods.

What makes your company’s approach unique?

While devulcanization itself is not a new concept, Tyromer’s process is relatively new. Using reactive extrusion, we are able to devulcanize rubber without the use of harmful additives, chemicals, or solvents. In this way, we differentiate from other processes that mainly rely on chemicals or on heavy physical processing. This is the most direct route for tire recycling because we are able to recover the majority of tire ingredients – the rubber compound.

Anything else you’d like to add?

Our strategy of open innovation and collaboration has helped Tyromer get to where we are today. As with many new technologies, the struggle was not just finding technical feasibility, but rather understanding how to fit into the tire and rubber industry on a global scale. Our licensing model is allowing us to create a global network of partners who can eventually supply recycled rubber anywhere in the world.

Tell us about your company.

Circularise is a pioneering blockchain technology company dedicated to bringing transparency and accountability to global supply chains. Our mission is to build a world where no resources are wasted due to a lack of information. We provide a unique solution that enables businesses to trace and verify the sustainability of their products, ensuring ethical sourcing and responsible manufacturing. Our technology is also instrumental in promoting recycling and circularity, helping companies and consumers make informed decisions that contribute to a more sustainable future.

Why is the technology your company works on important to the future?

The importance of our technology lies in its potential to reshape the way we view sustainability and resource management. As consumers become more environmentally conscious, they demand more transparent and sustainable practices. By leveraging blockchain technology, Circularise provides a secure, immutable record of a product's lifecycle, from raw materials to final product, into the recycling process and the product's end-of-life.

What makes your company’s approach unique?

Our approach is unique due to our patented 'Smart Questioning' technology. This allows companies to share information about their supply chains without disclosing sensitive business information, fostering trust among all stakeholders. Our Information Security Management System (ISMS) has recently been ISO 27001:2022 certified, which, as stated by our founder, Mesbah Sabur, "This not only validates the robust security supporting our software solutions but also fortifies our pledge to maintain customer trust and drive continuous innovation."

Anything else you’d like to add?

Our recent advancements include significant enhancements to our mass balance automation software for ISCC Plus and ISCC EU certifications, with plans to include other popular certification schemes. This software automates mass balance bookkeeping for plastics and biofuels, providing validated carbon footprint calculations. We are constantly innovating and expanding our partnerships to bring more transparency to supply chains worldwide, promoting sustainability and a better future for all.

With all the buzz around artificial intelligence and its impact on the workforce, it’s difficult to cut through the noise and understand how it can help the manufacturing industry make real changes.

Benefits of Artificial Intelligence

AI can empower manufacturers to hit their sustainability goals. Using AI levers could reduce greenhouse gas emissions by as much as 4% in 2030, equivalent to the 2030 emissions of Australia, Canada and Japan combined, according to PwC UK. In addition, AI programs can amplify automation and help manufacturers become more efficient. In turn, helping them achieve goals related to sustainability.

Economically speaking, AI used for environmental purposes is poised to bring positive impacts to the global economy. According to PwC UK, using AI for environmental applications could contribute up to $5.2 trillion USD in the global economy in 2030 – a 4.4% increase to the way things currently stand.

How Does AI Help Manufacturers?

Efficiency, of course. AI’s strongest bid with manufacturers is its efficiency. That can help producers in a few ways:

Make more. AI can boost production by optimizing systems to produce more and predict when machines need maintenance, reducing downtime. Plus, AI can help manufacturers produce higher quality products, reducing the need to redo a production run.

Sustainability. More efficient machines pollute less, it’s that simple. Plus, AI can help track essential metrics when it comes to sustainability reporting, saving manufacturers time and headaches.

Job creation is another benefit to manufacturers. While it may appear that AI reduces the number of employees needed to produce a product, the opposite is true. AI has the potential to create 38.2 million jobs across the global economy, according to a study from PwC UK and Microsoft. Technology like AI opens up the doors for employees to develop stronger analyses about productivity and efficiency. Plus, AI can be used to speed up training for other roles using digital twins, helping fill crucial positions in any facility.

Available Technology

Available AI-based technology primarily falls into three categories:

- Sustainability tracking: AI thrives on data. Tracking important metrics related to sustainability reporting is a natural fit. This is what Harvard Business Review calls the intersection of AI, sustainability, and project management.

- Optimization: As mentioned, optimization is a big piece of AI’s benefit. Reducing downtime, optimizing machine use, and more are all worthwhile for cost savings. Plus, it’s better for the environment.

- Automation: Data entry, errors, and more can all be automated using AI. These tasks are monotonous and can pull employees away from doing work that makes an impact on the bottom line.

From improving sustainability tracking to automating tedious tasks, AI use in manufacturing is still new, but the opportunities are endless.

Employees: 54

Headquarters: in the UK, with offices in Ireland, the US, Germany, Singapore, and Australia

Tell us about your company:

Circulor is the most mature and complete supply chain traceability solution available, with a particular focus on traceability for battery minerals and other materials that make the clean energy transition possible.

Since being founded in 2017, Circulor has been tracking and tracing critical materials to help their customers to prove the provenance, production flow, GHG emissions, and ESG credentials of cobalt, nickel, lithium, mica, copper, manganese, and graphite, to name a few. They already work at scale with numerous OEMs in the EV battery supply chains, including Volvo Cars, Polestar, Volkswagen, Daimler, and BMW —as well as midstream producers, miners, and recyclers.

Why is the technology your company works on important to the future?

Given the urgent need to reduce the impacts of climate change, there's a growing expectation from end consumers that the products they purchase are responsibly and sustainably manufactured. The answer to increased scrutiny on supply chain activity comes down to traceability. Circulor’s enterprise software solution helps businesses analyze, track, and manage their supply chains, creating data-driven decision-making for companies in their progress toward more responsible and sustainable sourcing.

We have all been talking about the EU Battery Regulation for quite some time now, which mandates that, from February 2027 onwards, battery passports will be required to share information on the origin and production journey of materials, embedded emissions, ethical and responsible sourcing, percentage of recycled content, and state of health and lifecycle management. Circulor offers a full lifecycle Battery Passport, which enables customers to meet these European regulatory requirements as well as the U.S. Clean Vehicle Tax Credit, which requires automakers and battery manufacturers to demonstrate that critical minerals and battery components are sourced and produced in the U.S. or free trade agreement countries.

What makes your company’s approach unique?